stock option exercise tax calculator

When you exercise youll pay. Your stock options cost 1000 100 share options x 10 grant price.

Stock Based Compensation Back To Basics

The Stock Option Plan specifies the employees or class of employees eligible to receive options.

. The company could award you a certain number of options but they might be vested over four years. Exercise incentive stock options without paying the alternative minimum tax. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Capital Gains and Stock Options. You own 10000 options one share per option to purchase common stock in your. You will only need to pay the greater of.

Review Outputs of NSO Tax Calculator. How much are your stock options worth. You pay the stock.

Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. When your stock options vest on January 1 you decide to exercise your shares. Taxation begins when the options are exercised and the taxes are calculated based.

On this page is an Incentive Stock Options or ISO calculator. Click to follow the link and save it to your Favorites so. Incentive stock option iso calculator.

The strike price of 2500 1000 250 Taxes on your phantom gain of 750 10 - 250 for every exercised option. Once all of the assumptions have been entered the NSO tax calculator will provide three outputs and they are all pretty self. Stock options are a tool to build employee loyalty over time.

Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options. Exercising stock options and taxes. This permalink creates a unique url for this online calculator with your saved information.

Stock Option Tax Calculator. Employee stock options are not taxable when granted. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Please enter your option information below to see your potential savings. On this page is a non-qualified stock option or NSO calculator.

The Stock Option Plan specifies the total number of shares in the option pool. Heres an example of how the tax costs can play out with the exercising of stock options. The stock price is 50.

Calculate the costs to exercise your stock options - including. How much youre taxed. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your.

Cash secured put calculator addedcsp calculator. NSO Tax Occasion 1 - At Exercise. Your taxes will be paid on 10 minus 5 equaling 5 per.

When To Exercise Stock Options

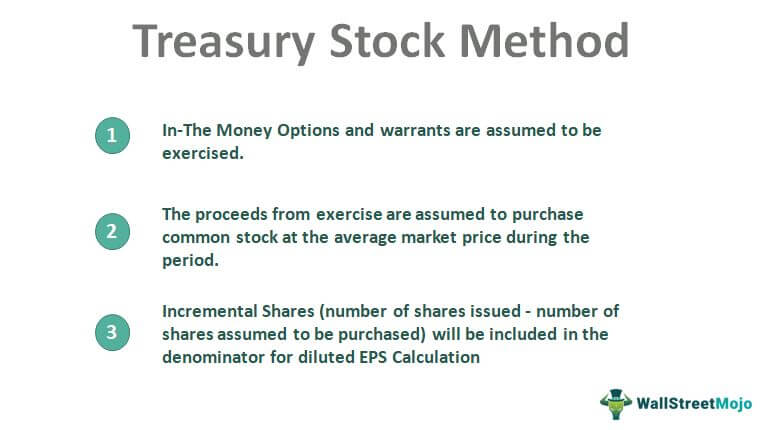

Treasury Stock Method Definition Formula Step By Step Guide

Secfi Stock Option Tax Calculator

Covered Call Writing The Elite Calculator And The Schedule D The Blue Collar Investor

Employee Stock Options Financial Edge

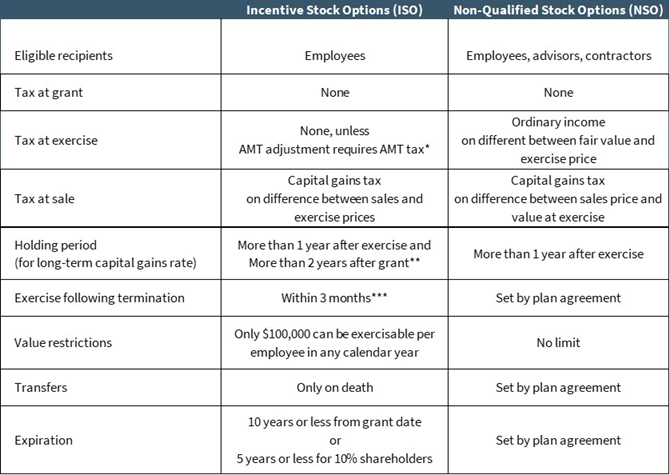

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

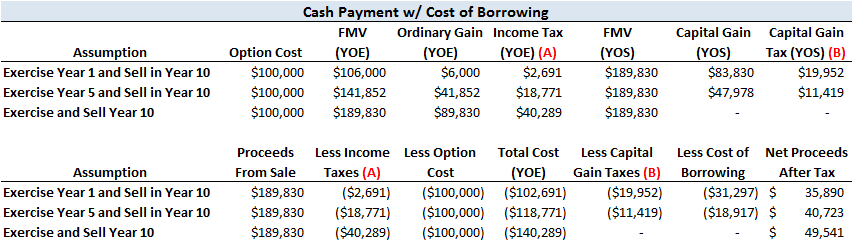

Startup Equity Calculating Potential Windfall Taxes And Costs

Secfi Stock Option Tax Calculator

How To Calculate Equity Value Equity Ipo Guide Wealthfront

Employee Stock Option Software Global Shares

How Are My Incentive Stock Options Taxed Kinetix Financial Planning

Employee Stock Option Fund Provides Easiest Way To Exercise Stock Options And Mitigates The Associated Risks Issuewire

Strategies For When To Exercise Your Stock Options

Non Qualified Stock Options Nsos

When Should You Exercise Your Nonqualified Stock Options

Employee Stock Option Fund Provides Easiest Way To Exercise Stock Options And Mitigates The Associated Risks Issuewire

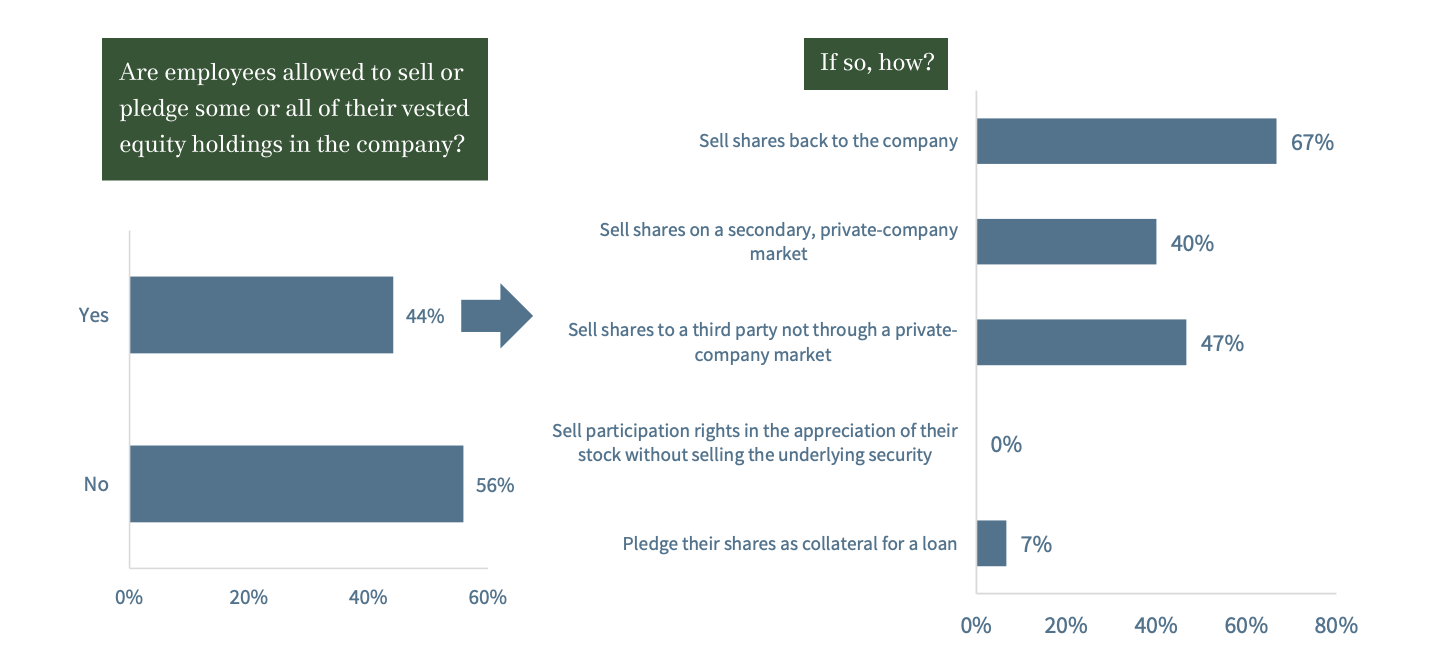

Stock Option Financing In Pre Ipo Companies

How To Report Stock Options On Your Tax Return Turbotax Tax Tips Videos